1. Rumor has it that automotive IC design houses are cutting orders, but large IDMs are still solid

According to the Taiwan Electronics Times cited by the Science and Technology Board Daily, automotive chip design manufacturers will increase their orders in the second quarter due to sluggish terminal demand.

Semiconductor industry insiders pointed out that Infineon, NXP, ST, TI, Renesas and other international automotive IDM factory orders are still solid, but some automotive chip design manufacturers recently for the 2nd quarter orders to adjust significantly, the ring drop of about 10%-20%. The products named for order adjustment include PMIC, driver IC, MOSFET and IGBT.

2. MCU demand less than expected, de-stocking continues into 3Q

Although the second quarter is the traditional peak season for MCUs, most of the industry confessed that overall orders remain weak and demand is less than expected, according to Money DJ, as quoted by Science and Technology Board Daily.

Industry executives confessed, "The MCU industry has never seen such poor conditions." From the point of view of inventory figures, the tone of MCU will go to inventory until the third quarter has been set, mainly because although the overall market order demand has been replenished before, but the pulling force is really not as good as previously expected, still for the 618 consumer season and preparation.

3. Texas Instruments' first quarter revenue and profit both fell significantly year-on-year

Local time on April 25, Texas Instruments (TI) announced the first quarter of this year's financial results, revenue of $4.379 billion, down 11% year-on-year; net profit of $1.708 billion, down 22% year-on-year.

By business, TI analog revenue of $3.289 billion, down 14% year-on-year; operating profit of $1.574 billion, down 27% year-on-year. Embedded processing business revenue of $ 832 million, an increase of 6% year-on-year; operating profit of $ 237 million, a decrease of 25%.

TI's president and CEO said the quarter saw weakness across the end market, except for the automotive industry. ti expects second quarter revenue to be in the range of $417-$453 million.

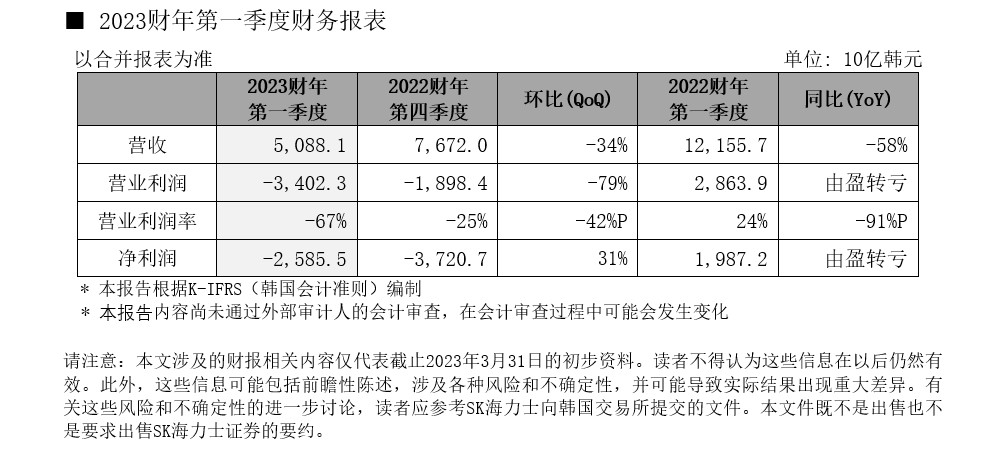

4. SK Hynix reported a net loss of nearly KRW 2.6 trillion in the first quarter

According to the news released by SK Hynix on April 26, the company reported a combined revenue of KRW 5.0881 trillion, an operating loss of KRW 3.4023 trillion and a net loss of KRW 2.5855 trillion for the first quarter of fiscal year 2023.

SK Hynix said that the memory market continued to be sluggish in the first quarter, with weak demand and declining prices leading to a decrease in the company's operating income for the quarter on a sequential basis and an increase in operating losses. However, with the first quarter as the low point, sales are expected to gradually increase and results will pick up in the second quarter.

The Company forecasts that market conditions will improve in the second half of the year as customer inventories turn downward in the first quarter and as memory production cuts from the second quarter onwards will result in the de-stocking of suppliers.

5. Fire at TSMC's Advanced Packaging and Testing Plant 6

On the evening of April 25, a fire broke out at TSMC's Advanced Packaging and Testing Plant 6, which is under construction in the Zhunan Science Park in Miaoli County, according to a number of local media reports cited by IT House.

The report said that the fire has been contained, burning area of about 300 square meters, including PP material machines, CPVC pipes and other ignited, after the firefighters rescue and enter the fire scene to investigate, to determine that there are no dangerous goods, the detailed cause of the fire pending further investigation.

6. TSMC's 3nm capacity cannot meet Apple's demand

According to MacRumors, TSMC is doing its best to produce enough 3nm chips to meet Apple's demand, but the supply still exceeds the demand. TSMC is founding the A17 chip for Apple's iPhone 15 Pro and iPhone 15 Pro Max, as well as the M3 chip for the MacBook series. Currently TSMC's 3nm process yield is around 55%, which is not yet enough to meet Apple's demand.

Starting at 10nm, TSMC's wafer prices have started to increase wildly, with 7nm wafers soaring to US$10,000 per wafer in 2018 and 5nm process wafers topping US$16,000 per wafer in 2020. And the price for 3nm reached US$20,000. This price is just a benchmark offer, and if a manufacturer's order quantity does not meet TSMC's requirements, the price will have to be higher.